Explore our comprehensive guide, [Documenting Home Damage for Insurance Claims: A Comprehensive Guide], and empower yourself with the knowledge and tools to accurately document home damage for insurance claims. By following our expert advice, you’ll be equipped to present a compelling case to your insurance provider, ensuring a fair and timely settlement for your property damage.

Key Takeaways:

- Make a thorough list of damaged items and take photos.

- Document the house’s condition prior to the damage.

- Keep a record of all conversations with insurance representatives.

- File your claim promptly within the policy’s timeframe.

- Get repair estimates from contractors.

Documenting Home Damage for Insurance Claims

Documenting home damage for insurance claims is crucial to ensure you receive fair compensation for your losses. Proper documentation provides evidence of the extent of the damage and supports your claim. Here’s a comprehensive guide to help you document home damage for insurance claims effectively:

Gather Supporting Evidence

- Detailed Inventory: Create a thorough list of damaged items, including their estimated value, description, and photographs.

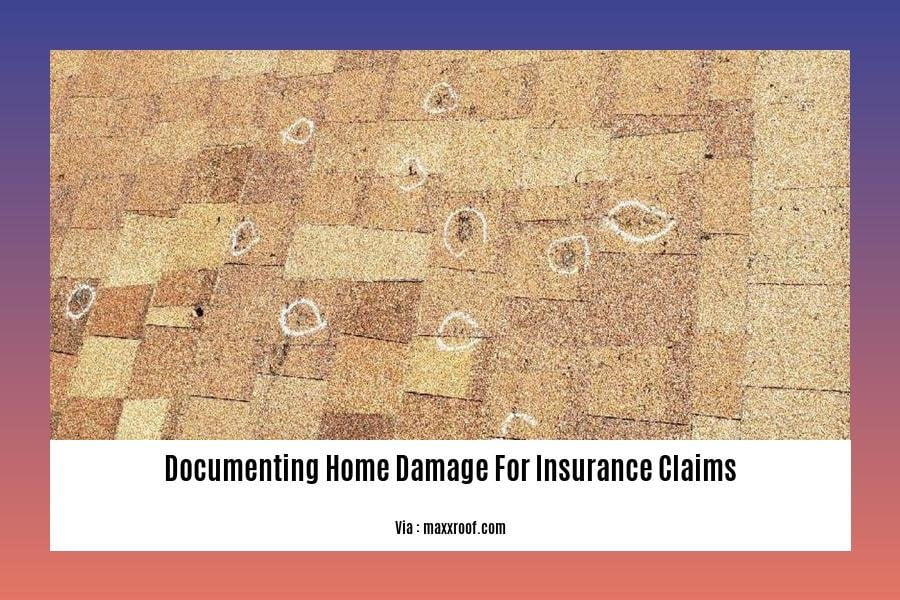

- Before-and-After Photos: Capture the damage in detail by taking photographs of the affected areas both before and after the incident.

- Receipts and Invoices: Keep receipts for any repairs or replacements made before filing a claim.

Communicate with Insurance Company

- Prompt Notification: Report the damage to your insurance company as soon as possible.

- Document Conversations: Keep a record of all conversations with insurance representatives, including dates, times, and key points discussed.

Timing is Key

- Policy Deadlines: Review your policy for the time frame within which claims must be filed. Adhere to these deadlines to avoid claim denial.

- Contractor Estimates: Obtain estimates from licensed contractors for the cost of repairs.

Additional Tips

- Clarity and Detail: Provide clear and detailed descriptions of the damage, including the cause, extent, and impact on your daily life.

- Stay Organized: Keep all documentation in a safe and accessible location for easy reference during the claims process.

- Seek Professional Help: If the damage is extensive or complex, consider consulting with a professional insurance adjuster for assistance with documentation and claims settlement.

Remember, thorough documentation is essential to support your insurance claim and ensure you receive fair compensation for your losses.

Navigate our comprehensive guide to the insurance claims process after natural disasters to ensure a smooth and successful claim experience.

In case of complex disaster claims, consider hiring public adjusters to maximize your settlement and protect your interests.

Stay informed about disaster insurance policies by understanding disaster deductibles and coverage limits to avoid unexpected financial burdens.

Note Location and Extent of Damage

When documenting home damage for insurance claims, accurately capturing the location and extent of the damage is crucial for fair compensation. Here’s how to do it:

1. Inspect and Assess:

Thoroughly inspect your property to identify all damaged areas. Note the location, type of damage, and affected components.

2. Photograph and Video:

Capture clear and detailed photos and videos from multiple angles. Include close-ups of specific damage and wider shots to provide context.

3. Annotate and Describe:

Label and describe the damage in your documentation. Use written notes or voiceovers in videos to explain the extent and severity of the damage.

4. Provide Context:

Include dates, times, and any relevant details about the cause and extent of the damage. This will help the insurance company assess the situation accurately.

5. Organize and Secure:

Keep all photos, videos, and notes organized and easily accessible. Store them digitally or in a physical folder for reference.

Key Takeaways:

- Thoroughly inspect and assess the damage.

- Capture clear and comprehensive photos and videos.

- Provide detailed written notes and descriptions.

- Include dates, times, and contextual information.

- Organize and secure all documentation for easy reference.

Most Relevant URL Source:

Documenting Damages for Your Home Insurance Claim

Obtain Estimates for Repairs

When it comes to insurance claims, obtaining estimates for repairs is a crucial step in ensuring that you receive fair compensation for the damage to your home. An estimate provides a detailed assessment of the repairs or replacements needed, along with the associated costs. Here’s why it’s important:

- Validates Your Claim: Estimates support your claim by providing evidence of the damage and the estimated costs to repair it.

- Proper Compensation: Accurate estimates help determine the appropriate compensation amount, ensuring you receive a fair settlement.

- Efficient Claims Process: Estimates streamline the claims process by clearly outlining the repair or replacement needs.

Steps to Obtain Estimates for Repairs:

- Contact Local Contractors: Reach out to reputable contractors in your area and request bids for the repairs.

- Provide Detailed Information: Describe the damage clearly, provide photographs, and supply any relevant documentation.

- Compare Estimates: Review multiple estimates from different contractors to identify the most reasonable and competitive prices.

- Negotiate Costs: If necessary, negotiate with the contractor to ensure the costs align with your budget and insurance coverage.

Key Takeaways:

- Estimates are essential for validating claims, determining compensation, and streamlining the claims process.

- Homeowners should contact local contractors and provide detailed information when requesting bids.

- Comparing multiple estimates helps ensure fair and competitive pricing.

- Homeowners may need to negotiate costs with contractors to align with their budget and coverage.

Most Relevant URL Source:

Preserve Evidence for Verification

As you prepare to file an insurance claim for home damage, preserving evidence is crucial for a successful outcome. Here’s why it matters:

Insurance companies have a duty to act in good faith: They are legally bound to honor their policies and fairly compensate you for covered losses.

Documentation protects your rights: Thorough documentation of the damage provides irrefutable proof of your claim and helps you secure fair compensation.

Key Takeaways:

- Protect the evidence: Limit access to the damaged property to prevent further damage or tampering.

- Document everything: Take detailed photos and videos of the damage, capture close-ups and wide shots, and include contextual information (dates, locations, descriptions).

- Create an inventory: List damaged items with descriptions, values, and supporting documentation (receipts, invoices).

- Keep records: Track all expenses related to the damage, including temporary repairs, cleaning, and professional services.

- Request a copy of your policy: Review the policy carefully to understand your coverage and the documentation requirements.

Most Relevant URL Source:

– Texas Department of Insurance: Homeowners Insurance Claims

FAQ

Q1: What are the key steps when documenting home damage for insurance claims?

A1: To ensure a successful claim, homeowners should thoroughly document the damage with photographs and videos, create a comprehensive inventory of damaged items, maintain records of conversations with insurance representatives, and file the claim promptly.

Q2: What is the significance of organizing documentation for insurance claims?

A2: Well-organized documentation enables homeowners to quickly and easily access necessary information, facilitating a smooth claims process and expediting the settlement.

Q3: Why is it crucial to provide contextual information while documenting damage?

A3: Contextual information, such as dates and descriptions, helps establish the timeline and circumstances of the damage, providing valuable support for the claim’s validity.

Q4: What is the role of an insurance claim estimate in the claims process?

A4: An accurate and detailed insurance claim estimate serves as a vital tool in evaluating the validity of the claim, determining the appropriate compensation amount, and streamlining the claims processing for both homeowners and insurance companies.

Q5: What should homeowners do if their insurance company doesn’t respond to their claim promptly?

A5: In such cases, homeowners should refer to the specific regulations and laws in their jurisdiction regarding the timely handling of claims. They may consider seeking legal advice or reaching out to relevant agencies for assistance in resolving the issue.