Unlock the secrets to successful fundraising with our comprehensive guide on [Pitching Investors for New Business Funding: Unlock the Power of Effective Communication]. This article will equip you with proven strategies and expert insights to craft a compelling pitch that resonates with investors and attracts the funding you need to propel your business to new heights.

Key Takeaways:

- Explore funding options like Revenue-Based Financing and Business Funding up to $2 million.

- Apply for term loans online quickly and easily.

- Access Commercial Real Estate Funding with a streamlined process.

- Consider SBA Business Loans with flexible terms tailored to business needs.

- Connect with over 100 lenders for loan types such as SBA Loans, ACH Loans, and Equipment Loans.

- Find Loans for Women and Angel Investors.

- Utilize Funded.com to connect with potential investors.

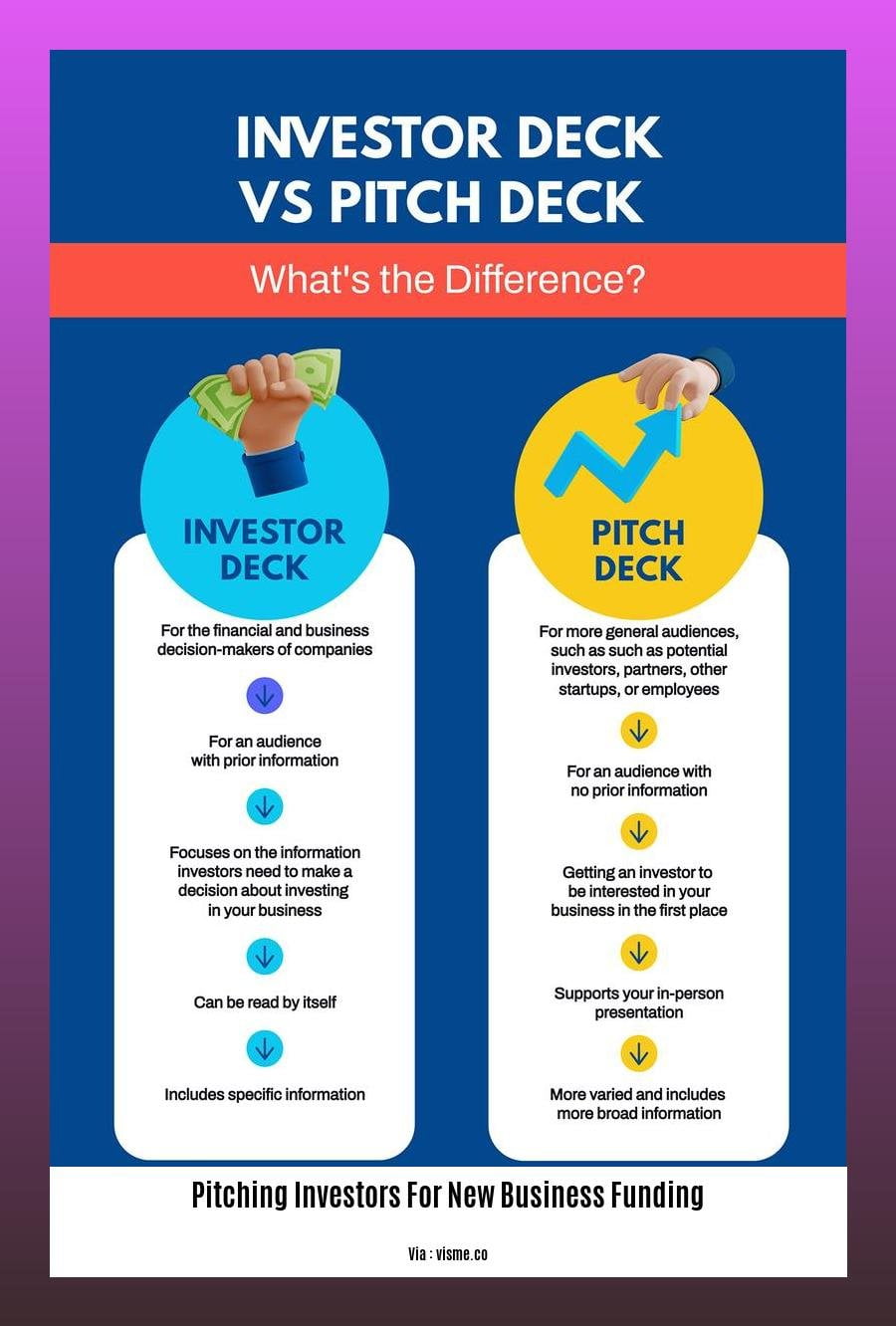

- Craft a compelling pitch deck and conduct thorough market research for effective investor pitches.

Pitching Investors for New Business Funding

Preparing Your Pitch

- Know your audience: Research investors who align with your industry, stage of development, and funding needs.

- Craft a compelling story: Highlight your company’s unique value proposition, market potential, and competitive advantage.

- Quantify your results: Use data and metrics to demonstrate the impact of your solution and its potential for growth.

Delivering a Successful Pitch

- Start with a bang: Captivate investors with a hook that sets the tone for your presentation.

- Keep it concise: Present the key elements of your business in a clear and succinct manner.

- Use visual aids: Slides and infographics can help illustrate your points and enhance engagement.

- Be confident and enthusiastic: Your passion for your business will translate to investors.

- Handle questions effectively: Prepare for potential questions and answer them with confidence and clarity.

Securing Investment

- Follow up effectively: Send a thank-you note and reiterate key points to keep your company top-of-mind.

- Negotiate wisely: Be prepared to discuss terms and conditions that align with both parties’ interests.

- Build relationships: Nurture connections with investors who believe in your vision and can provide ongoing support.

Fundraising Options

Consider various funding options to suit your business needs:

| Option | Features |

|---|---|

| Venture Capital: Equity investments in early-stage companies with high growth potential. | |

| Private Equity: Investments in established companies seeking expansion or restructuring. | |

| Crowdfunding: Raises funds from a large number of individuals through online platforms. | |

| Business Loans: Debt financing with fixed interest rates and repayment terms. |

Did you just start your business and are finding investors for new businesses? Then worry no more because we are here for you! Get insights, tips, and advice on how to excel in your new business.

If you are now attracting investors for a new startup, then you are in the right place! This article will give you the secret ways on how to attract potential investors for your new startup business.

Finally, if you have no clue on how to find investors for your startup, make sure to check this out! Finding investors for your startup business is not a walk in the park. That is why we made this article to guide you through the right steps.

Practice and Refine Your Pitch

In the competitive business world, delivering an effective pitch that captivates investors and propels your business forward is paramount. Mastering this skill involves relentless practice and refinement. Here’s a guide to help you elevate your pitching game:

Key Takeaways:

- Preparing your pitch thoroughly ensures clarity and impact.

- Practice regularly to build confidence and seamless delivery.

- Anticipate questions and craft compelling responses.

- Seek feedback to identify areas for improvement.

- Understand your target audience and tailor your pitch accordingly.

Preparation:

- Research potential investors and tailor your pitch to their interests.

- Develop a compelling narrative that highlights your company’s value proposition.

- Quantify your impact with data and metrics.

Practice:

- Rehearse your pitch in front of a mirror or a trusted advisor.

- Time yourself to ensure you stay within the allotted timeframe.

- Record and review your practice sessions to identify areas for improvement.

Delivery:

- Start with a captivating hook that grabs attention.

- Maintain clarity and enthusiasm throughout your presentation.

- Use visual aids to illustrate your points effectively.

- Practice handling questions confidently and engagingly.

Seek Feedback:

- Ask for feedback from mentors, colleagues, or friends.

- Listen attentively and be open to constructive criticism.

- Use feedback to refine your pitch and elevate its effectiveness.

Target Audience:

- Understand your target audience’s interests, concerns, and motivations.

- Tailor your pitch to resonate with their specific needs.

- Research industry-specific trends and incorporate them into your presentation.

By following these steps, you can practice and refine your pitch to maximize its impact on potential investors. Remember, practice makes perfect, and each iteration will bring you closer to delivering a winning presentation that unlocks new opportunities for your business.

Citation: How to Prepare a Business Pitch that Will Win Over Investors

Follow up and nurture relationships

Building solid relationships with investors is crucial for long-term success in fundraising. Here are some tips to follow up and nurture relationships:

1. Regular communication: Stay connected with investors through regular updates. Share progress reports, industry insights, and company milestones.

2. Personalized follow-ups: Tailor your follow-ups to each investor’s interests and involvement level.

3. Value proposition: Continuously highlight how your company aligns with the investor’s investment thesis and goals.

4. Relationship-building events: Organize or attend industry events and conferences to connect with investors on a personal level.

5. Seek feedback and input: Regularly ask investors for feedback on your business and strategy. This shows you value their insights and are committed to their support.

Key Takeaways:

- Regular communication and progress updates strengthen investor relationships.

- Personalized follow-ups demonstrate your understanding of each investor’s interests.

- Highlighting your alignment with their investment goals builds trust.

- Attending industry events provides opportunities for personal connections.

- Seeking feedback showcases your commitment to investor involvement.

Citation:

- Elevate Your Investor Outreach: Master Follow-Up Emails:

Close the deal and secure funding

You’ve got a great business idea, you’ve done your research, and you’ve put together a solid pitch. Now it’s time to close the deal and secure funding.

Here are a few tips to help you close the deal and secure funding:

**Do your research Before you even approach investors, do your research and understand their investment criteria. Know who the right investors are, what they are looking for, and how they make decisions.

**Craft a compelling pitch Your pitch is your chance to make a great impression on investors and convince them to invest in your business. Make sure your pitch is clear, concise, and persuasive.

Be prepared to answer questions Investors will likely have questions about your business, your team, and your financial projections. Be prepared to answer these questions thoroughly and honestly.

Negotiate terms that are in your best interests Once you have an offer from an investor, don’t be afraid to negotiate terms that are in your best interests. Remember, it’s your business and you should make sure that the terms of the deal are fair to you.

Close the deal Once you have negotiated terms that you are happy with, it’s time to close the deal. This means signing a contract and getting the funds you need to get your business off the ground.

Key Takeaways:

- Do your research: Understand who the best possible investors are and know what they look for in a business.

- Create a compelling pitch: This is your opportunity to make an impression on investors. Make it clear, concise, and persuasive.

- Be prepared to answer questions: Investors will want to know about your business, team, and financial projections.

- Negotiate terms that are in your best interests: It’s your business, and the terms of the deal should be fair to you.

- Close the deal: Once you’ve negotiated terms you’re happy with, sign the contract and get the money you need.

Most Relevant URL Source:

- How to Close the Deal and Secure Funding