Understanding the intricacies of Rating Flood Insurance Premiums and Costs is a crucial step in securing adequate coverage for your property against flood damage. As flood insurance premiums can vary significantly depending on individual risk factors, navigating the complexities of rating methodologies is essential for informed decision-making. This article aims to shed light on the factors that influence flood insurance costs and provide insights into assessing risk and optimizing coverage to ensure financial protection in the event of a flood.

Key Takeaways:

- Average flood insurance premium in the US is $859.

- Cheapest state for flood insurance: Nevada ($593).

- Most expensive state for flood insurance: Connecticut ($1,491).

- Average flood insurance cost increase under Risk Rating 2.0 is 86%.

- Properties with annual flood insurance premiums under $1,000 have an average replacement cost value of $494,090.

Rating Flood Insurance Premiums and Costs

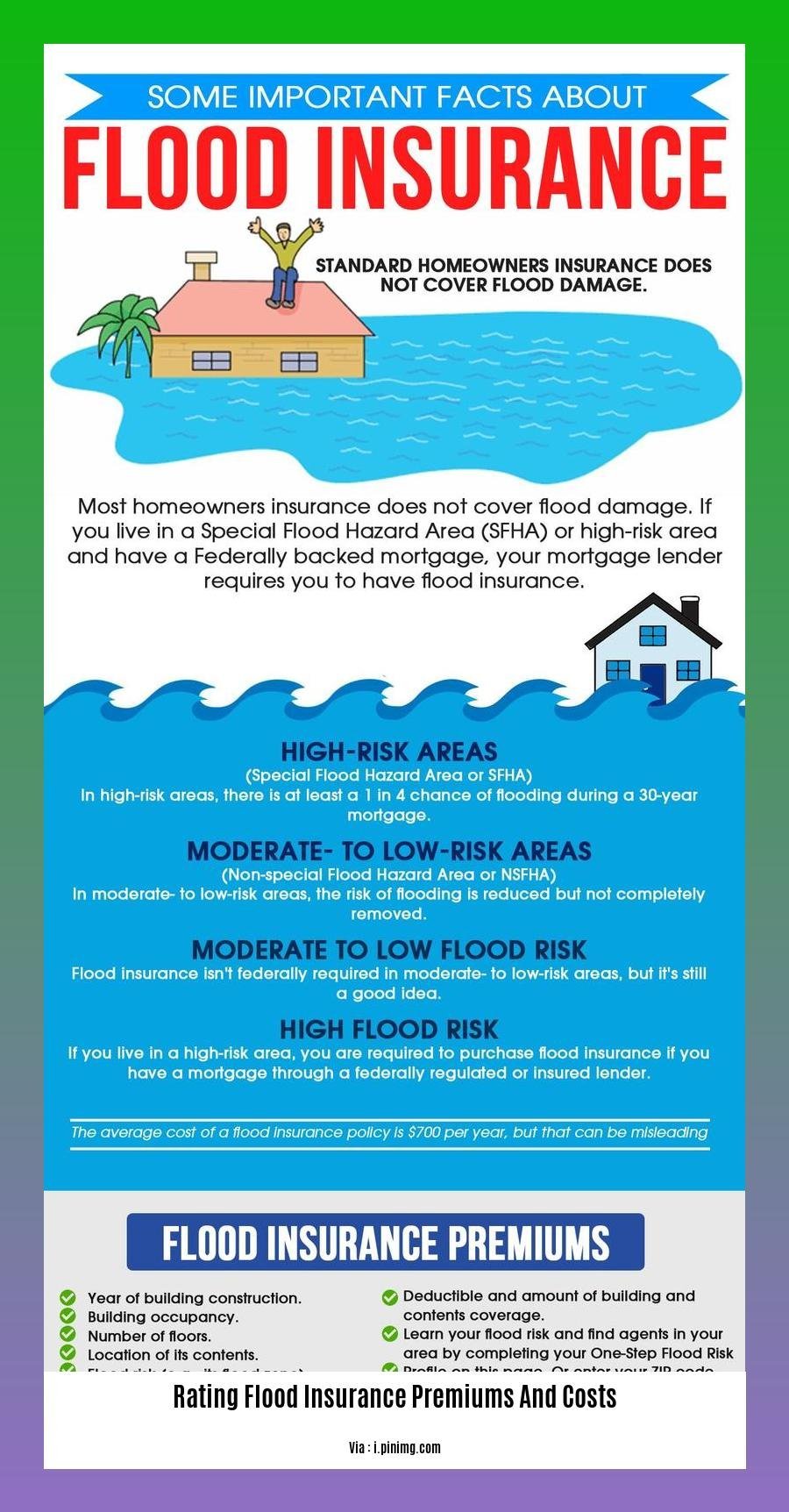

Understanding how flood insurance premiums and costs are determined is crucial for property owners in flood-prone areas. Here’s a breakdown of the factors that influence these costs:

Location: Location plays a significant role in flood insurance costs. Properties in high-risk flood zones will pay higher premiums than those in low-risk zones.

Building Characteristics: The type of building, its elevation, and its construction materials all affect the premium. Homes built on elevated foundations and with flood-resistant materials will have lower premiums.

Flood History: Properties with a history of flooding will have higher premiums. This is because insurance companies assess the risk of future flooding based on past events.

Coverage Amount: The amount of coverage you choose will impact the premium. Higher coverage amounts result in higher premiums.

Deductible: The deductible is the amount you pay out-of-pocket before insurance coverage kicks in. Choosing a higher deductible can lower your premium.

Subsidies: The National Flood Insurance Program (NFIP) offers subsidies to policyholders in certain areas. These subsidies can reduce premiums significantly.

Risk Rating 2.0: FEMA’s new pricing system, Risk Rating 2.0, considers more granular factors to rate flood insurance premiums and costs. This system aims to reflect the true flood risk of each property more accurately, leading to potential premium increases for some policyholders.

Remember, rating flood insurance premiums and costs is a complex process. It’s essential to work with an insurance professional who can assess your specific risks and help you determine the appropriate coverage and premium.

Prepare yourself against the harsh realities of flooding with our comprehensive guide to flood insurance requirements by risk zone. Stay informed about flood zone determination and elevation certificates to avoid any potential surprises. Furthermore, ensure compliance with mandatory flood insurance areas to safeguard your financial well-being.

Factors Affecting Flood Insurance Premiums: Building Characteristics and Location

Flood insurance premiums are influenced by several factors, including the building’s characteristics and location. Here’s how these elements can impact your costs:

Building Characteristics

– Foundation Type: Elevated homes with flood-resistant foundations reduce flood damage risk and lower premiums.

– Building Occupancy: Residential homes typically have lower premiums than commercial or industrial properties due to lower flood risk.

– First Floor Height: Higher first floor elevations above ground level reduce flood exposure and decrease premiums.

– Number of Floors: Multi-story buildings have higher flood risks and premiums compared to single-story structures.

– Construction Type: Buildings made of flood-resistant materials, such as concrete or elevated wood, have lower premiums.

– Flood Openings: Opening and access points in lower levels can increase flood damage risk and premiums.

Location

– Proximity to Flooding Sources: Homes near rivers, coasts, or floodplains face higher flood risks and premiums.

– Ground Elevation: Properties located in low-lying areas with higher flood risk have higher premiums than those on higher ground.

– Flood Zones: Federal flood zones designate areas with different flood risks and premium rates. Higher-risk zones have higher premiums.

Key Takeaways:

- Buildings with flood-resistant features, such as elevated foundations and flood-resistant construction, reduce premiums.

- Properties in high-risk flood zones and near flooding sources have higher premiums.

- The number of floors, first floor height, and flood openings can influence premiums based on flood risk.

Citation:

FloodSmart. (n.d.). Rate Explanation Guide.

Government Subsidies and Private Market Options

Navigating the complexities of flood insurance can be daunting, especially when it comes to government subsidies and private market options. Let’s simplify it:

Factors Impacting Flood Insurance Costs

Your flood insurance premium is influenced by various factors:

- Location: Proximity to water bodies and elevation affect risk.

- Building Features: Foundation height, materials, and flood-resistant measures influence costs.

- Coverage: The amount of coverage impacts premiums.

- Deductible: Higher deductibles lower premiums.

Government Subsidies

The National Flood Insurance Program (NFIP) offers subsidies to make flood insurance affordable for high-risk areas. However, government subsidies are being phased out gradually.

Private Market Options

Private insurers offer flood insurance policies that may complement or compete with NFIP. These policies can provide additional coverage or cater to specific needs. Private market options can help diversify the flood insurance market and encourage competition.

Key Takeaways:

- Location, building characteristics, coverage, and deductibles determine flood insurance costs.

- Government subsidies reduce premiums in high-risk areas, but these are being phased out.

- Private insurers offer alternative flood insurance options that can supplement or compete with NFIP.

- Diversifying the flood insurance market through private options fosters competition and flexibility.

Citation:

US Government Accountability Office: Flood Insurance

Mitigation Measures and Their Impact on Flood Insurance Costs

Consider Mitigation Measures and Their Impact on Flood Insurance Costs to save money on your premiums.

- Elevate Your Home: Raising your home above the base flood elevation reduces flood risk and lowers premiums.

- Install Flood Openings: Flood openings allow water to enter and exit your home safely, preventing damage and lowering rates.

- Move Valuables to Higher Floors: Storing valuable belongings higher up minimizes flood damage and reduces insurance costs.

- Join the Community Rating System: Communities involved in the CRS implement flood mitigation measures, earning discounts for their residents.

Key Takeaways:

- Mitigation measures can significantly lower flood insurance premiums.

- Installing flood openings, elevating homes, and moving valuables to higher floors reduces flood risk and lowers rates.

- Participating in the Community Rating System offers additional discounts for communities with flood mitigation programs.

Citation: FEMA: Flood Insurance and Risk Rating 2.0

FAQ

Q1: How is FEMA’s Risk Rating 2.0 impacting flood insurance premiums?

A1: Risk Rating 2.0 considers location, building characteristics, and replacement cost to determine premiums, resulting in an average increase of 86%.

Q2: What factors influence the cost of flood insurance?

A2: Location, elevation, building type, number of floors, and proximity to flooding sources are key factors that affect flood insurance premiums.

Q3: How can I reduce my flood insurance costs?

A3: Installing flood openings, elevating your home, and relocating valuables to higher floors can lower flood insurance rates.

Q4: What is the average cost of flood insurance in the US?

A4: The national average cost of flood insurance is $859 annually.

Q5: How does the replacement cost value (RCV) impact flood insurance premiums?

A5: Homes with flood insurance premiums under $1,000 have an average RCV of $494,090, indicating a strong correlation between replacement cost and insurance costs.